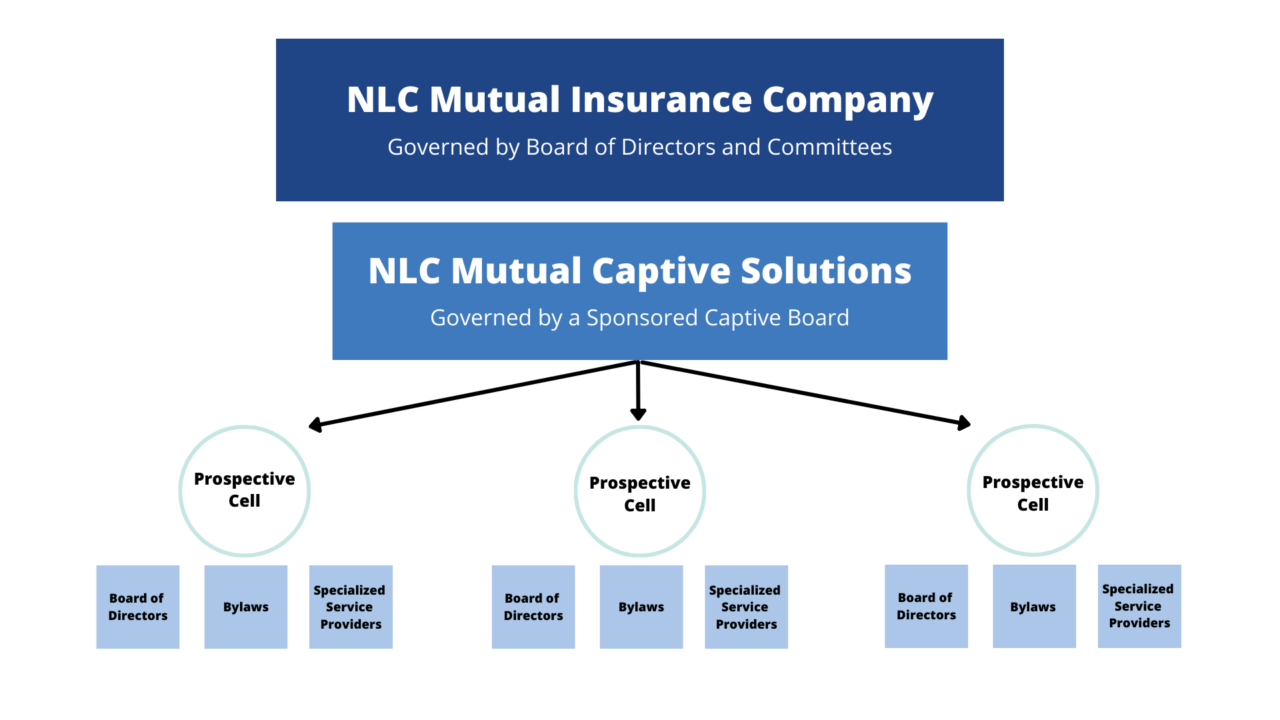

NLC Mutual Captive Solutions, Inc. is a risk financing alternative for Mutual members which was formed January 1, 2022. There are various reasons that a member may want to join or create a separate Incorporated cell. To learn more about creating a new incorporated cell, please explore the FAQs below.

Unique Benefits to Forming a Cell Under NLC Mutual Captive Solutions, Inc.

- Captive Solutions is licensed by the State of Vermont, which is a leader in forming and regulating captives.

- Ability to leverage existing partnerships with expertise in captive formation, management, and oversight.

- With startup costs being paid for by NLC Mutual there is significant savings for new members. Expenses can also be spread across cells, leveraging additional cost savings.

- Unique ability to provide an alternative risk financing solution focused on common exposures that are challenging to cover for but necessary for local governments.

FAQs

How is Captive Solutions governed?

Captive Solutions has its own Board of Directors consisting of the First and Second Vice Chairs of NLC Mutual, President of NLC Mutual, other Directors, as well as a Secretary and Treasurer. The role of the Captive Solutions Board of Directors is to ensure that each cell formed is complying with financial and regulatory requirements set forth by the State of Vermont.

What is an Incorporated Cell?

An Incorporated Cell is a separate legal entity with its own participation agreement and bylaws, as approved by the Captive Solutions Board. These cells have the ability to “wall-off” certain risks from existing Mutual reinsurance business, or member insurance programs, without risk to their assets and capital.

Does Captive Solutions govern each cell and/or retain any risk?

No, each cell retains the risks and assets of the cell and has its own:

- Board of Directors

- Bylaws

- Articles of Incorporation

- Participation Agreement*

- Specialty Service Providers (as needed)

*The Participation Agreement outlines the roles and responsibilities for each cell. The sponsored captive also manages compliance including audits, financial reports and regulatory filings.

What risks can be covered by a cell?

Generally, there are no limitations on the types of risks that can be covered by a cell. That said, each proposed cell will provide a feasibility analysis to determine if creation of a cell for the intended purpose will yield a strong likelihood of success. Each proposed cell must be approved by the Captive Solutions Board of Directors and Vermont regulators.

Can a member create a cell for their pool only?

Yes. The pool would still need to submit a business plan and feasibility analysis for consideration and approval by the Captive Solutions Board.

What are the characteristics of a strong captive opportunity?

- Greater than $5M in premium

- Under 50% loss ratio

- 10 years of loss/premium history available

- Risk management or long-term cost savings in place

- Owner financial strength (major public entity and/or pools of smaller entities)

- Owner/risk manager has a stake and interest in leading the project

A feasibility analysis can help evaluate whether the opportunity will yield a strong likelihood of success.

Interested in Learning More?

Please contact our Chief Operating Officer Erin Rian at 202-626-3122, or submit a request using our contact form.